You can work as many jobs as you want to make more money for a goal (travel, a car, house, etc.), but if you can’t save it, it’s futile. But the secret of saving money isn’t simply locking it up in the bank. You have to be smart about how you spend it, how you don’t spend it and how you view the products you could be spending your hard-earned money on.

I wish I could remember the blog on which I first read this piece of advice so I could give attribution, but nonetheless, it’s the best savings advice I was ever given. When we see an item we’d like to buy, we first think about 1) whether we can take it with us on our RTW and 2) if it’s food or personal items, do we want it or truly need it?

We’ve gotten in the habit of asking ourselves these questions, and therefore view every product differently now. We’re no longer buying new clothes just because the season changed from fall to winter. Even if it’s an item we could use upon return, we’d rather store less versus more and save the money for our trip. A win-win for sure.

Of course we still buy food, but do we need to go out to eat? Or to a bar when we could do happy hour at home with friends? Look at your other habits and cut out superfluous spending, like manicures at a salon, gym memberships (hello, great outdoors…or stairwell!) and cable TV.

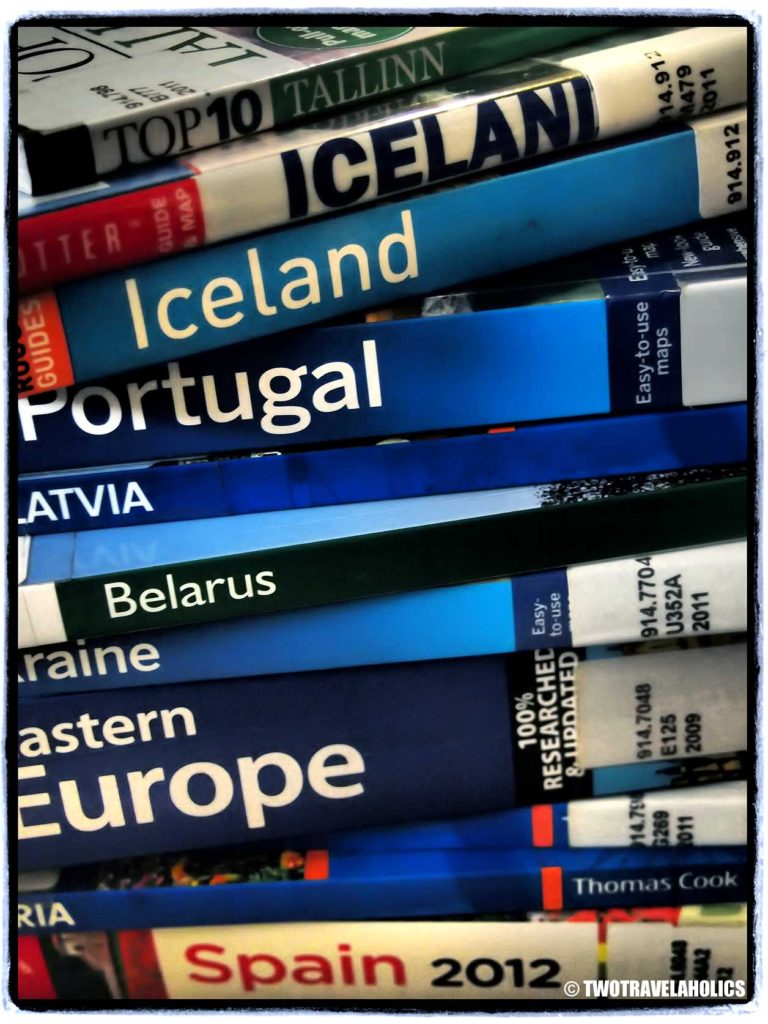

Cutting spending on the nonessentials doesn’t mean you have to eliminate them from your life. Start familiarizing yourself with your new best friend: the public library. Why buy books and DVDs when you can borrow them — for free — for weeks or months? Your taxpayer dollars are even paying for free Wi-Fi and public computers — so use them! And spending time at the library will also keep you away from other money-sucking activities you might be participating in instead.

While you’re at the library, you can do a little math to help you reach a monthly spending goal. Include in this your housing costs, a food budget, transportation and a goal for miscellaneous spending. Give that final number a hard look and find a way to reduce it. Now that you have a monthly spending goal amount in mind, give yourself a pay cut. Set up your paycheck to deposit your monthly goal in a checking account that you can use to pay bills and get cash from. Put the remainder of your paycheck into a savings account — that you won’t touch! — with the highest interest you can find. Bankrate is a great website to search for accounts with the highest yields.

If giving yourself a pay cut isn’t challenging enough, make a new year’s resolution that includes weekly or monthly challenges that will drive down your costs. (You can still make resolutions even in the middle of the year!) You might consider the following 0challenge: no alcoholic beverages in January. Not only is this healthy for your liver, but it will certainly save you some serious cash if you currently drink multiple times a week (maybe I should take up this challenge). Are you up for it?

You’re a fun habit, but you cost more than a coffee.

In May or a month with nicer weather, you can resolve to walk anywhere within a 1.5 mile radius instead of driving or taking public transportation. In August, you can put yourself in a vegan’s shoes and cut out meat, dairy and eggs. Imagine what you’ll save on groceries! Your cholesterol levels will thank you, too.

So far, none of our advice has been to starve yourself, so how do you save on the things you do have to purchase? Yes, you can clip coupons, wait for a sale or grab promo codes off Retail Me Not. But you can also hold out for the Groupon-like deals that are really worth it. LivingSocial now runs deals where you pay $1 for $10 worth of food. That’s certainly cheaper than buying dinner at the grocery store. Amazon runs daily Gold Box discounts on random items. So if you’re shopping for gifts, electronics, travel items, etc., bookmark this site. Scout Mob is another great deals site (available only in the States). On Scout Mob, you’re not required to buy a deal (it’s kind of like a coupon), and all deals are 50% or 100% off. That’s right, free burrito coming atcha! Sooo worth it.

Also, you can’t expect to hole yourself up at home and never go out with your friends. If you do go out, be prepared with a deal you bought online or through restaurant.com. Never pay full price for something you can buy cheaper! Just be mindful of any minimum spending requirements stated in the fine print. Don’t put yourself in a position of having to spend $35 to get $10 off if you weren’t planning to spend $35.

Starting habits like all of these will put you in a position to start saving what you’re earning. And you don’t have to put your social life on hold to do it either. There are plenty of free events out there, and no one can fault you for wanting to avoid the costly ones in order to save toward a goal.

What are your best money saving tips?

Great article and the tips are good whether prepping for a career break or saving for travel or something else. One thing a big trip (ie round the world, career break etc) helps with is you know you have to let go of ” stuff” so it makes resisting buying easier. I also found after extended travel I got used to simplified choices and the overwhelming consumerism and options wore me out upon return to US. It’s freeing to only have a few outfits to choose from.each day!

It’s been so long since I paid a visit to my ‘best friend’ the PL. I’m afraid if I go back, they might ask me where and what I did to their Magic School Bus books I ‘forgot’ to return. Hahaha. Luckily, Gerard’s been able to find really cheap books and guides to download to our Kindle. All great tips to save $. Best of luck in 2012! Can’t wait to read all about it.